child tax credit 2021 dates irs

That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. July 15 August 13 September 15 October 15 November 15 December 15 To unenroll or enroll for.

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Families across the country only.

. Get the credit you deserve with the earned income tax credit EITC. The IRS bases your childs eligibility on their age on Dec. Understand that the credit does not affect their federal benefits.

If you dont have a tax balance itll become a refund. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per kid for children. Wait 5 working days from.

Heres what you need to do. The credit for qualifying children is fully. Youre running out of time to unenroll from the December payment.

If you work and meet certain income guidelines you may be eligible. Find out if they are eligible to receive the Child Tax Credit. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll.

HomeNewsTech Child tax credit 2021. 15 The payments will be made either by direct deposit or by paper check depending on what. For example families across the country only received 50 of the child tax credit back in June of 2021.

31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. The remainder will come when parents file. The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17.

Visit ChildTaxCreditgov for details. It provides information about the Child Tax Credit. Besides the July 15 payment payment.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Monthly payment dates opt-out deadlines IRS portal details. The IRS is sending families the September installment of the 2021 Child Tax Credit on the 15th but how long will it be before it arrives in bank accounts.

Update your direct deposit info or mailing address through the IRS portal. For both age groups the rest of the. The IRS is distributing half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child.

Earned income credit. The same goes for errors with refundable tax credits such as the. The IRS pre-paid half the total credit amount in monthly payments from.

The IRS says the monthly payments will be disbursed on these dates. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Here are the official dates.

You expect to owe at least 1000 in tax for 2022 after subtracting your withholding and refundable credits.

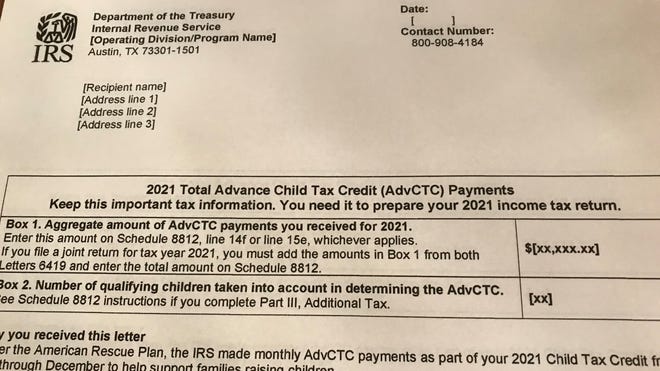

What Is The Irs Child Tax Credit Letter 6419

What To Know About How Covid 19 Pandemic Changed Tax Laws

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Additional Child Tax Credit What Is It Do I Qualify Picnic

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit 2021 What You Need To Know

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

Irs Warns Parents Not To Toss Important Tax Document

Explaining Recent Irs Letters About The Child Tax Credit Youtube

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

Irs Warns Parents Not To Toss Important Tax Document

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Advance Payments Of The Child Tax Credit I M Definitely Eligible Why Does It Says I M Not R Irs

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit Schedule 8812 H R Block

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

What Families Need To Know About The Ctc In 2022 Clasp

Irs On 2021 Tax Information For Stimulus Checks Child Tax Credits

News On 2021 Child Tax Credit Refunds Irs Hiring Plans Canon Capital Management Group Llc